Overview

Sustainability has long been a focus of the logistics real estate industry, primarily expressed through building design and energy efficiency. With the significant growth of e-commerce and its outsized contribution to logistics demand, it is prudent to evaluate sustainability with this new and growing use in mind.

E-commerce is improving the sustainability of retail, according to careful academic studies that measure end-to-end environmental impacts. The key to greater sustainability in retail is reducing the transportation impact—the largest source of emissions for the U.S. as a whole. Here, e-commerce is substantially more efficient. By consolidating goods transportation into trucks and vans making several deliveries on a circular route, rather than individual point-to-point trips by consumer vehicles, the carbon footprint of transportation falls by more than 50% as measured by kg CO2e. In addition, the faster pace of adoption of EVs by delivery companies (compared to the larger consumer vehicle fleet) is widening the CO2 savings of online versus in-store shopping. While packaging for e-commerce is greater, it does not outweigh the transportation savings created by online shopping. In total, the end-to-end environmental impact is estimated to be roughly 15% lower for online versus in-store shopping.

Introduction

Leading research from MIT, GRESB, Carbon Management, and others using comprehensive statistical modeling has quantified the carbon footprints of retail modalities. An end-to-end accounting of carbon footprints reveals e-commerce to be more sustainable than traditional brick-and-mortar retailing. Transportation is the biggest driver of environment impact, and e-commerce is substantially more efficient with consolidated delivery. In addition, the future points to further decreased emissions, as continued supply chain optimization yields both environmental and operational benefits. There are three aspects of today’s sustainability advantages that, when taken together, forge a significant sustainability advantage built for the long term:

- Location strategy—the positive effect of the ever-evolving supply chain. Today’s supply chain is placing network operations closer to end consumers, in turn reducing carbon emissions, lowering total vehicle miles traveled and cutting operating costs.

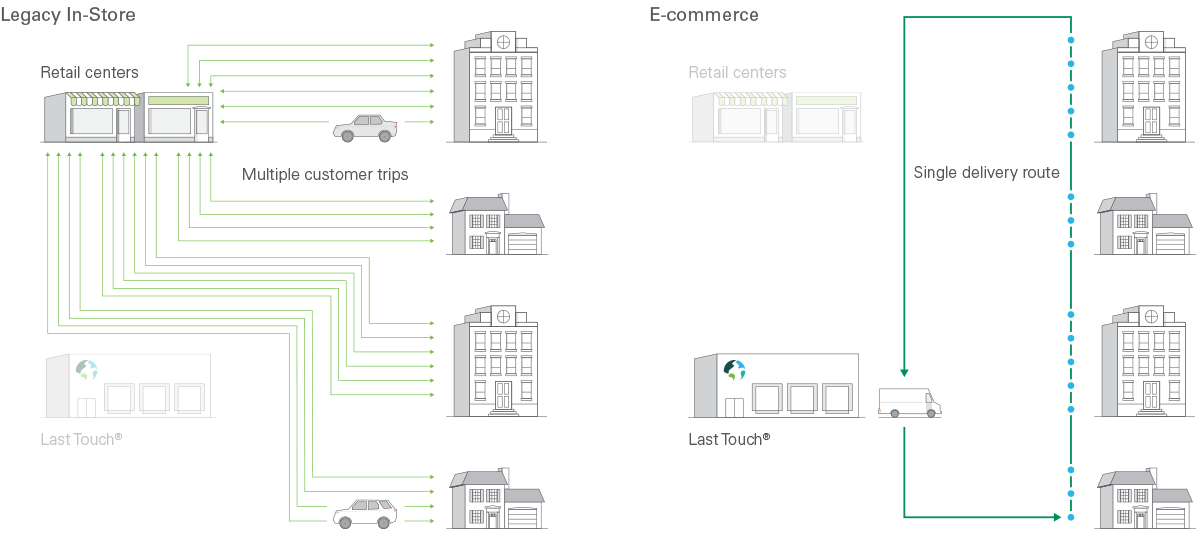

- How it’s happening: Locating goods near end consumers creates environmental benefits by consolidating packages to maximize the load capacity of goods entering a city. Not only do Last Touch® and City Distribution facilities (learn more in our two-part property classification report) require proximity to consumers, they provide an opportunity to reduce overall transport emissions via more efficient distribution (see Exhibit 1). This delivery strategy is aided by analytics and technology that make it possible to choose the most efficient routes. Academic studies estimate that the transportation portion of the environmental impact for e-commerce is less than half that of in-store shopping, even after incorporating a higher return rate (see Exhibit 2).

Exhibit 1

SIGNIFICANT TRANSPORTATION SAVINGS FROM E-COMMERCE NETWORK

- Sales channel—e-commerce operators are actively seeking to reduce costs through order consolidation and network optimization. By concentrating the movement of goods into an aggregated and optimized network, online shopping’s carbon footprint can be up to 50 percent less than that of traditional retail, making e-commerce more sustainable than its brick-and-mortar counterpart. Different shopping patterns have different impacts on the environment. For instance, basket size, return rate and number of trips affect the carbon footprint of a purchase.

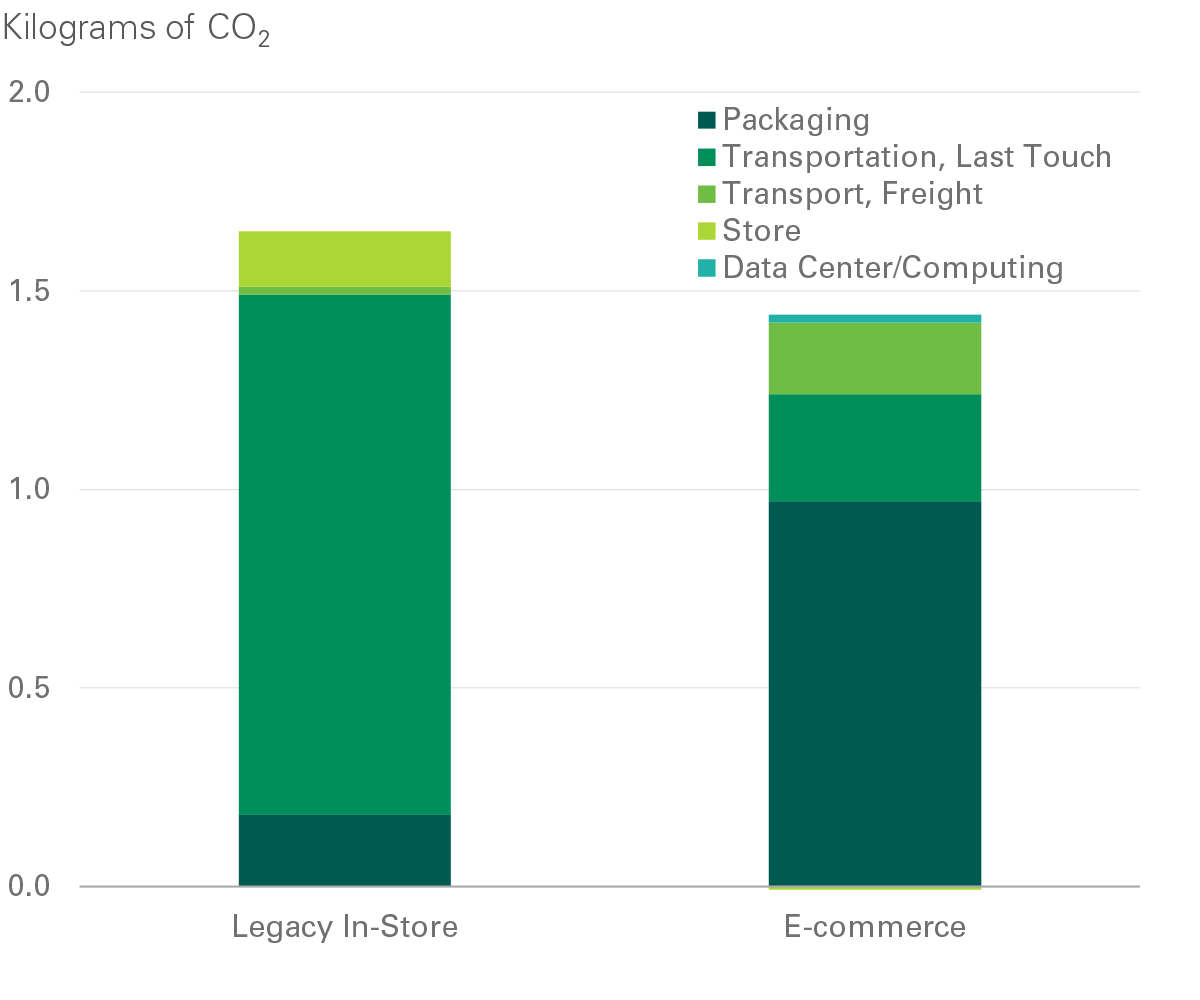

- How it’s happening: When a consumer shops online, the consumer makes no trips to the store to search for and purchase products. The order is instead consolidated with other consumers’ orders, placed into a large delivery truck and set on a single delivery route. This efficient method of product delivery significantly outweighs the carbon footprint that would be incurred were each individual consumer to travel to and from stores to make their purchase, according to MIT.2 In fact, as more goods are ordered online, efficiency also rises. Packaging levels are higher for e-commerce compared to traditional shopping methods; they are estimated to contribute roughly 1.0 kg CO2e and comprise the majority of the environment impact of online shopping, but they are less than the transportation impact (roughly 25% less) of traditional in-store shopping (see Exhibit 2).

Exhibit 2

CARBON DIOXIDE (CO2) EMISSIONS BY RETAIL FORMAT

Source: Environmental Analysis of US Online Shopping,

MIT Center for Transportation & Logistics - Technology—the future is already here. As logistics real estate owners and users increasingly embrace renewable energy and sustainable building technologies to reduce their overall carbon footprint, the near- and long-term benefits are very real.

- How it’s happening: Delivery via electronic vehicles is rising and is economically viable. More than 90 percent of the trips by parcel delivery vehicles are within a 100-mile range—a feasible distance for zero-emission vehicles. Increasing adoption of EVs has the potential to more than halve the environmental impact from transportation for e-commerce. Looking ahead to the customer and investor side, the key is to place decision-making around sustainable commerce directly in the hands of logistics customers. Those customers who invest in green technologies will stay ahead of their competition and win the loyalty of consumers and investors whose concerns around sustainable commerce will only increase with time.

Case Study: Sustainable transportation technologies are on the rise across Europe.

Major European cities have introduced zero- and ultra-low emission zones. Trucks enter these cities at night when there is less traffic and deliver packages to smaller facilities near consumers. In the morning, cargo bikes and electric vans haul them to consumers’ doorsteps.

- The Takeaway—Night delivery results in more efficient unloading and a reduction in emissions.

In Closing

Logistics real estate is leading its commercial property peers in energy efficiency, aided by sustainable design features. Increasingly, well-located logistics real estate is a key component in optimizing supply chains and sustainability in the age of e-commerce. The concentration of distribution in urban areas will both enable reduced carbon output and make it a requirement versus an option. At the same time, the growth of e-commerce is aiding sustainability, as the aggregation of shopping trips into direct-to-home truck deliveries becomes increasingly efficient, even after accounting for additional packaging and higher return rates. In addition, the adoption of sustainable EV and transportation technology is rising alongside demand for environmentally-conscious consumer goods. This analysis represents the first of Prologis Research’s study of this evolving topic. We remain committed to tracking sustainability and will do so as technologies, consumer habits and adoption rates evolve.

To learn more about Prologis’s specific commitments to sustainability, see more in the Sustainability section of Prologis.com.

Endnotes

- Environmental Analysis of US Online Shopping, MIT Center for Transportation & Logistics

- Environmental Analysis of US Online Shopping, MIT Center for Transportation & Logistics

- U.S. National Renewable Energy Laboratory (NREL)

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forwardlooking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of September 30, 2019, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 797 million square feet (74 million square meters) in 19 countries. Prologis leases modern logistics facilities to a diverse base of approximately 5,100 customers principally across two major categories: business-to-business and retail/online fulfillment.